Basics of Medicare Questions and Answers

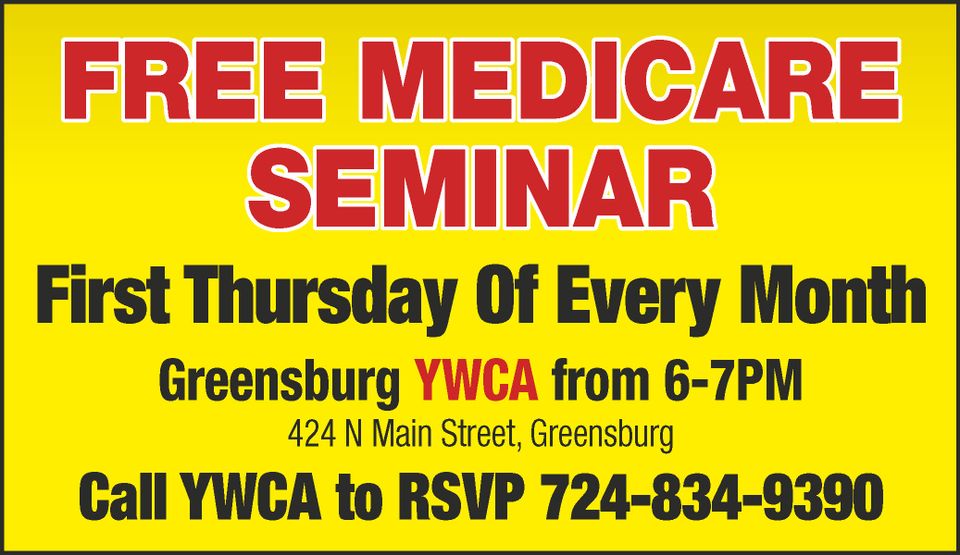

I get a lot of questions at my “Discover Medicare” seminars. Thought it might be helpful to share them with you. This is the first in a series of questions on the basics of Medicare. What is Medicare?

Medicare is our national health insurance program for three groups of people: 1) 65 and older, 2) under 65 with certain disabilities, 3) any age with End-Stage Renal Disease (E S R D). Medicare is administered by the Centers for Medicare & Medicaid Services ( C M S ).

I get many questions at my “Discover Medicare” seminars. I am passing them along. This is the second in a series of questions on the basics of Medicare. What does Medicare cover?

There are four parts to Medicare. Part A is hospital insurance and is free for most of us. Part B medical insurance which costs $175/month, or more if your income is higher than average. Part C Medicare Advantage Plans which have monthly premiums from $0 to $46. Part D prescription drug coverage which is included in most Medicare Advantage Plans with no extra fee, and stand-alone prescription drug plans that cost as little as 50 cents per month to over $100 per month.

During the next few weeks, I will be recounting some of the questions I am asked at my “Discover Medicare” seminars. This is the third in a series of questions on the basics of Medicare. When and how do I sign up for Medicare?

The Initial Enrollment Period is three months prior to the month you turn 65 until three months after. You enroll through Social Security, either in person, by phone or online at socialsecurity.gov

This is the fourth in a series of questions on the basics of Medicare asked at my “Discover Medicare” seminars. What if I’m not retiring at age 65? Can’t I stay on my employer health plan and not sign up for Medicare?

It is best to enroll in Part A of Medicare and delay Part B while you continue to work and stay on your employer plan or if your spouse continues to work and you are on your spouse’s employer coverage. Whenever you (or your spouse) quits working, you can then apply for Part B without incurring any penalty.

Many questions get asked at my “Discover Medicare” seminars and I am answering some of them here. This is the fifth in a series on the basics of Medicare. What is the Part B penalty you can get for not signing up for Medicare when you’re supposed to?

Not enrolling in Part B when you turn 65 can result in a 10% penalty added to your monthly Part B premium. This extra 10% is attached every twelve months during the time you fail to enroll. It remains there forever. One exception to the rule is when you or your spouse continues to work past age 65 and you remain on the employer health plan.

This is the sixth question and answer in a series discussing the basics of Medicare. If you do not sign up for Medicare when you first turn 65, when can you next apply?

The General Enrollment Period (GEP) is January 1 through March 31 each year. Your coverage is effective the month after you enroll. If you miss it there is a 10% penalty for each twelve months you are eligible but not enrolled. That penalty is attached to your Part B premium and you must pay it for as long as you have Part B.

This is number seven in our weekly series covering the basics of Medicare. What is Original Medicare?

Original Medicare is Part A and Part B of Medicare. Part A is hospital insurance and covers inpatient hospital care, skilled nursing facility care, home health care and hospice care. Part B is medical insurance and includes doctor visits, outpatient medical services, clinical lab tests, preventive services and durable medical equipment.

Today we continue our series about the basics of Medicare. These are questions asked at my Discover Medicare seminars. Our eighth query is: What does Medicare cost?

Medicare Part A is free if you or your spouse worked and paid FICA taxes at least ten years. The cost for Part B is based on your annual income and this year is $174.70 per month for most of us. Part C is Medicare Advantage Plans which this year should cost you as little as $0 and no more than $46 each month. Part D Prescription Drug Plans will be discussed next week.

This is the ninth week in our series of questions and answers about the basics of Medicare. Last time we discussed Medicare Parts A, B and C while answering the question: What does Medicare cost?

Part D is Prescription Drug Plans. Those that are part of Medicare Advantage Plans cost nothing extra. Whatever you pay each month for the advantage plan also includes the drug plan at no extra cost. Stand-alone Prescription Drug Plans are available to join if you elect a Medigap Supplement Plan. They can cost anywhere from less than a dollar to more than one hundred dollars per month.

We continue with our examination of Medicare basics. This is week 10. What is a Medigap Policy?

It is Medicare supplemental insurance that is sold by private companies. It complements Medicare by filling in the gaps and paying the deductibles, coinsurances and copayments that Medicare does not cover. Medigap Plans are lettered and all plans with the same letter have the same coverage. Plan G or Plan N with one company has the same coverage as Plan G or Plan N with a different company. The cost can vary from one company to another. You can go to any doctor or hospital that accepts Medicare, anywhere in the country, and have little or no copayments.

Our eleventh question on the basics of Medicare is: What does a Medigap Supplement Plan cost?

Cost is based on gender, age and zip code. Prices vary from one company to the next even though coverage is exactly the same. The monthly premium for Plan G can be anywhere from just under $100 to almost $150. Plan N varies between $80 to $103. There are no copayments with Plan G, but Plan N requires $20 for a doctor’s office visit and $50 at the ER. You pay a yearly deductible of $240 with either plan.

Question #12 in our Discover Medicare series is: Do I need a Medigap Plan?

It complements Medicare Parts A & B and allows you to utilize any hospital or doctor anywhere in the country that accepts Medicare, with little or no copayments on your part. Prescription drug coverage is not included and neither are dental, vision or hearing benefits. When you first turn 65 and enroll in Medicare Part B you can purchase any Medigap Plan regardless of your health status.

Question #13 is: Which Medigap Supplement Plan is the best one?

Plan G and Plan N are the top two requested at this time. Both allow you to go to any doctor or hospital approved by Medicare anywhere in the country. Both have a $240 annual deductible. Plan G costs $30 to $40 more per month than Plan N. You pay no copayments with Plan G. Plan N requires that you pay $20 at any doctor’s office and $50 at the emergency room.

Q. Our next question on Medicare basics, #14, is: What about Medicare Advantage Plans?

A. The advantage plan you choose becomes your health plan. You show only your plan membership card and never need to present your Medicare card. Most plans include prescription drug coverage. They also offer many extra benefits. Dental, vision and hearing coverage for example. Silver Sneaker gym memberships. Over The Counter health and wellness products.

Q. Continuing with question #14 about Medicare Advantage Plans.

A. Plans cost between $0 to $50 per month. There are no deductibles but you are required to make copayments. Your doctor and hospital must be in the “network”. Certain medical procedures require prior authorization from the insurance company. You are always covered for emergencies anywhere you travel out of your local area. During the Annual Election Period Oct 15 to Dec 7 you can enroll into any advantage plan being offered in your area.

Q. Question #15 in our Medicare basics series is: What is a MOOP?

A. That stands for Maximum Out Of Pocket. Medicare Advantage Plans have a cap on what you can pay in any year. It is the total of all your deductibles and copayments. Different plans have different MOOPs, ranging from $3900 to $7550. Once you reach your MOOP, you pay zero for the remainder of the year. Copayments for prescription drugs are not included in calculating the MOOP.

Q. Question #16 in our weekly discussion about Medicare basics. When I turned 65 I was still working and on my employer’s health plan. I signed up for Medicare Part A. Now that I’m retiring, how do I get Part B?

A. It is a simple process. There are two forms to complete and submit to your local Social Security office. You complete and sign the Application For Enrollment In Medicare Part B. Your employer completes and signs the Request For Employment Information. These forms are available online or at the Social Security office. I can email them to you also. Either take the completed forms or fax them to your local Social Security office. The Greensburg Social Security office phone number is 877-748-9768 and fax number is 833-950-3529.

Q. This is our 17th and final question in our Medicare basics series. What is the donut hole?

A. I am happy to report that beginning in 2025 there will no longer be a coverage gap (donut hole). Once your total yearly out-of-pocket drug costs reach $2000, you will pay zero for your prescription drugs for the remainder of the year. Your total yearly drug costs will be capped at $2000.